Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

August 2021 market review: South Africa

August was a volatile month for local markets. The cabinet reshuffle, new economic data from Stats SA and tightening Chinese regulations all had an impact.

Reset

In early August, President Cyril Ramaphosa announced a cabinet reshuffle, which included much-anticipated changes to the security cluster and a new health minister, following the resignation of Zweli Mkhize. Most influential for markets, however, was the appointment of Enoch Godongwana as finance minister.

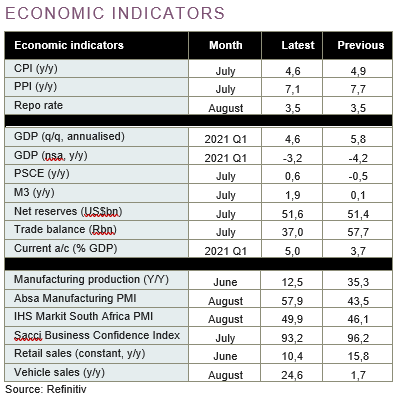

Stats SA released revised estimates of the size of the South African economy, accounting for new information and a new base year. GDP for 2020 is now estimated at R5,52 trillion, 11% larger than the previous estimate. The overall trends regarding real GDP growth, however, remain troubling and the changes to real GDP estimates are much lower. But the new base will improve key economic metrics, such as the government debt to GDP ratio, even if it does not change the absolute debt numbers. The Department of Mineral Resources and Energy gazetted the regulations to raise the threshold for self-generation to 100 MW from 1 MW, a significant step forward for generation capacity and potential growth.

This came in the wake of an explosion at Medupi power station, dealing another blow to Eskom and an already stretched grid.

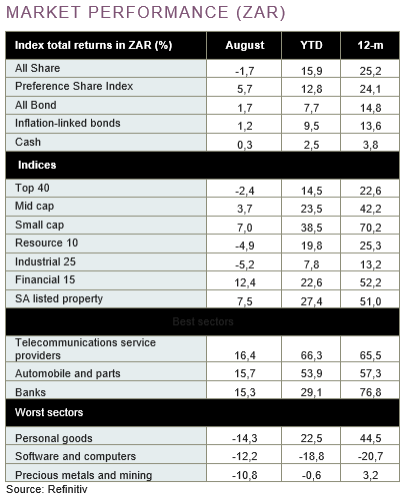

Inflation for July was recorded at 4,6%, a further moderation from the 5,2% peak in May, as the impact of base effects subside. Fuel and food prices are two of the main drivers of higher inflation and will remain key to monitor. Inflation-linked bonds returned 1,2% over the month. The All-bond Index gained 1,7% in August, bringing the returns over the year to 7,7%.

The local equity market experienced some volatile trading sessions in August, with the FTSE/JSE All-share Index ending the month down 1,7%. A decline in the resources sector (-4,9%), particularly precious metals, added to losses from index bellwethers Prosus (-2,7%) and Naspers (-12,1%), which declined on the news of tighter regulations in China.

Domestically exposed small- and mid-cap counters outperformed large-cap counterparts, while the property sector finished the month up 7,5%. Local equity indices experienced a reset of their own, with the JSE experiencing a record level of trading as money managers adjusted portfolio positioning to account for the new weightings of Naspers and Prosus in indices following the share swap concluded by the company.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.