Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

June 2021 market review: International

Although economic performance and activity differ across regions, they remain influenced by global inflation concerns, vaccination and oil supply-and-demand dynamics.

Reopening delayed

The divergence in vaccination campaigns between the developed and the emerging economies has been made even more stark by the spread of the Delta variant across the world. Pledges from G7 members of vaccine supplies to those in need, including South Africa, will go some way towards improving timelines and staying ahead of new variants and reinfection. The recovery in economic activity in the services sector is increasingly adding to global economic growth, even if the full reopening of economies remains elusive.

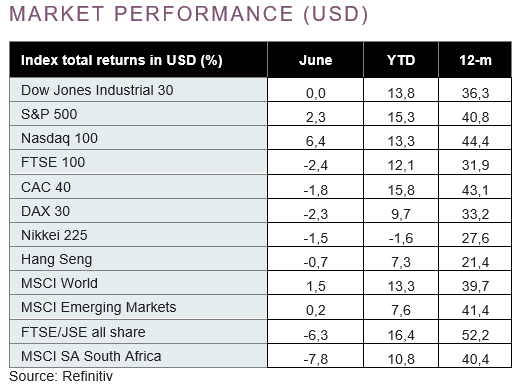

Despite regional differences, risk assets delivered a strong performance in the second quarter, with the MSCI World Index gaining 7,9%. The S&P 500 advanced 8,5%, underpinned by a strong corporate earnings season, approval of further fiscal stimulus and a rebound from technology stocks in June, which helped the technology-heavy Nasdaq 100 gain 11,2% over the quarter. European markets staged a credible comeback as vaccinations accelerated and economies reopened, despite lacklustre Q1 GDP prints. With markets concerned about policy tightening in China, in addition to regulatory changes, Asia underperformed on a relative basis.

For many countries, inflation prints over the quarter exceeded expectations, but a similar result for US inflation gauges and the resultant US Federal Reserve (Fed) response were the main bellwether for market volatility. Having priced for this outcome in advance and with a more hawkish tone emerging from the US Fed in June, the US 10-year bond yield fell back roughly 30 bps from the peak March levels to end the quarter at 1,4%.

In US dollar terms the Bloomberg Barclays Global Aggregate Bond Index returned 1,3% in June. This provided an even greater tailwind over the quarter for other fixed-income assets, including inflation-linked bonds, emerging-market debt and corporate credit.

Transitory to tapering

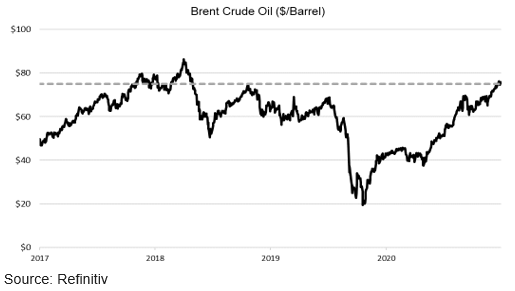

Ending the second quarter above the $75 a barrel mark, the oil price hit its highest level since 2018. After the lows of the pandemic-induced lockdowns, weather-related disruptions to supply was a driver for the increase in price. More recently, however, a rebound in global activity and hence demand, in conjunction with supply discipline from the oil majors, has been the more prominent driver. While demand is likely to continue improving, there should ultimately also be some normalisation of supply. Its timing, will be influenced by the outcome of the Opec+ meeting at the start of July, with members discussing the cautious increase of supply. In the meantime the lack of investment in the sector remains a concern for some market participants, especially given the impact of higher fuel prices on global inflation.

Global central banks have started to use language showing that they are more alert to the potential for pricing pressures beyond base effects. The US Fed continues to support the premise that inflationary pressures will be transitory but refined their communication at the June meeting to reflect a slightly more hawkish stance. The median committee (Federal Open Market Committee or FOMC) members now expect two interest rate hikes in 2023, bringing forward the tightening cycle. While the monetary policy setting will remain accommodative for some time to come, the level of support will likely abate. Talk of tapering or the withdrawal of liquidity will no doubt become one of the main drivers of potential volatility for markets that have become used to, if not dependent on, easy financial conditions.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.