Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

March 2022 market review: International

War and global sanctions against Russia, inflation concerns, an interest rate hiking cycle, and a series of supply shocks affected global financial markets in March.

The Russia–Ukraine war dominated headlines over the month, but markets also kept a keen focus on insights from key central bank meetings. Sanctions against Russia intensified, with several countries, including the United States (US) and UK, announcing bans on oil imports from Russia. A number of global companies have voluntarily shunned buying oil from the country and others have closed operations temporarily. Index providers, notably MSCI and FTSE, removed Russian equities and bonds from their benchmarks, which will likely prompt further outflows from this market. With financial sanctions impacting the currency and its conversion, whether the country will be able to continue to service their hard-currency sovereign debt payments remains a key concern. Progress in talks between Russia and Ukraine prompted some optimism for a de-escalation of military action, helping to stabilise markets. With the war waging on multiple fronts though, Russia has demanded that natural gas payments be made in Russian rubles from 1 April, although the demand was tempered by allowing payments in other currencies through a designated bank.

Not to be forgotten, Covid-19 cases in Europe have been on the increase. Countries around the world are transitioning to living with the virus and restrictions continue to be eased. In contrast, China has remained steadfast in its low-tolerance response. With the country battling a new wave of infections, China implemented regional lockdowns, including of Shanghai and Shenzen, both economically important with export linkages. While the disruption is being managed by staggering restrictions in Shanghai for example, it is likely to worsen supply chain challenges for certain products.

Despite some calls from within the group for an increase in production, OPEC+ members, which include Russia, maintained a gradual increase in production. The price of Brent crude oil traded in volatile fashion on news flows over the month, including attacks on storage facilities in Saudi Arabia and storm damage to a pipeline in Russia, which added to energy supply concerns. After intramonth highs, the price of Brent crude oil moderated into month-end as the US announced the release of a million barrels of oil per day from its strategic oil reserves for six months.

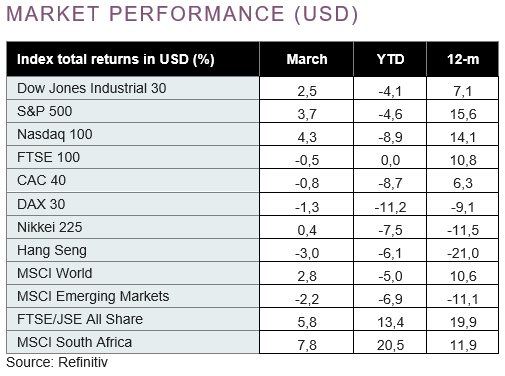

Although equity markets recovered some lost ground in March, global equity and bond markets declined over the quarter as the turn of interest rate cycles, more hawkish central banks and impact from the war reverberated across markets. Year to date the MSCI World Index has declined by 5,0%, while the MSCI Emerging Markets Index has lost 6,9%. There was a sell-off in global bond markets, under pressure from high-inflation prints and hawkish central banks, with the loomberg Global Aggregate Bond Index declining by 3,0% in March, bringing the year-to-date decline to 6,2%. US bond markets recorded one of the worst quarterly declines in decades.

Added complexity

The US Federal Reserve started its interest rate hiking cycle with a 25 bps increase, but there have been increasing calls for a 50 bps move from several Fed governors, which set the tone for market movements. The Bank of England increased interest rates by 25 bps, with interest rates now back at pre-pandemic levels. Eurozone preliminary inflation figure for February printed at 5,8% on the back of higher energy prices, the highest figure since the euro was introduced and re-emphasising the region’s vulnerability to the impact of the Russia–Ukraine war. The European Central Bank kept rates unchanged and brought forward the end of their asset purchase programme to Q3, suggesting that inflation concerns currently still outweigh growth concerns.

Policymakers are now facing the added complexity of multiple supply shocks and data that remain fluid in the face of the conflict. Against this backdrop the US bond yield curve has inverted. Historically, this is seen as a bearish signal of slowing growth, with markets pricing in an inflationary problem that requires higher interest rates in the near term, alongside an even higher probability of a recession in a few years from now. Although a better indicator of trend rather than of timing, the markets assessment of risks, at a minimum, will weigh on policymakers’ minds in the months to come.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth Pty Limited and its subsidiaries (we, us, our) have issued this communication for information purposes only, so you must not rely on it as though it is advice, without getting financial, tax or other professional advice. We collected the information in this communication from various sources, and have included facts and events or market conditions that were current at the time of going to print. We do not warrant that this information is complete or accurate, or have anything to say about whether it is appropriate for investors in all jurisdictions to use this information. The opinions and recommendations given may change without notice. We and our employees may hold securities or financial instruments mentioned in this information. This information is not an offer or solicitation of financial services or products, and we do not accept liability for any loss or damage, including, but not limited to, loss of profits or any financial or other monetary or direct or special indirect or consequential loss, however arising, whether arising from negligence or breach of contract or other duty as a result of this information being used or relied on. Nedbank Private Wealth, an authorised financial services provider through Nedgroup Private Wealth Pty Ltd Reg No 1997/009637/07 (FSP828), a registered credit provider through Nedbank Ltd Reg No 1951/000009/06 (NCRCP16), a member of JSE Ltd through Nedgroup Private Wealth Stockbrokers Pty Ltd Reg No 1996/015589/07, an authorised financial services provider (FSP50399) and a registered credit provider (NCRCP59). |