Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

Benefit from a strong rand

Our international expertise and platform can help you – with our Focus platform you have convenient access, seamless control and expert support for your international investments.

By Hein Klee, Head of International at Nedbank Private Wealth

01 December 2020

A stronger currency does not necessarily benefit everyone in the economy.

When the value of a currency rises so that the currency is exchanged for more of other currencies, we say the currency ‘appreciates’ or ‘strengthens’. If the exchange rate falls and the currency trades for less than other currencies, we say it ‘depreciates’ or ‘weakens’. The common perception is that stronger currency is better than a weak one. But the terminology can be confusing. A stronger currency benefits some people and sectors in the economy, but it also hurts others. It is therefore not necessarily better; it is just different.

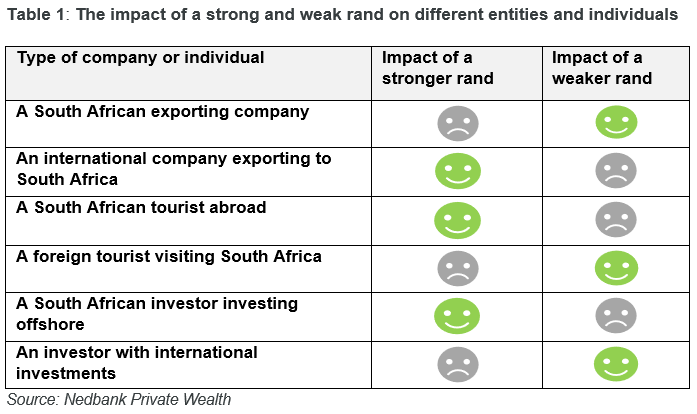

This is how the strength or weakness of the rand affects different companies and individuals.

The table below shows the impact of both a strong and weak rand on different entities and individuals. It shows how different parties benefit from and are negatively affected by both a strong and a weak rand.

Sending money abroad is one of the simplest ways to take advantage of a strong rand.

You can do this using your annual investment allowances. All South African citizens older than 18 may send up to R11 million offshore every calendar year. For the first R1 million you send you won’t need tax clearance from SARS. This is called your discretionary allowance. For the next R10 million you can use your foreign investment allowance, for which you’ll need tax clearance from SARS.

Once your money is offshore, you can choose how to invest it, for example putting it in an interest-bearing account. We highly recommend getting professional advice about your options in the country you are planning to invest in to ensure you are aware of all the legal implications, practicalities and risks.

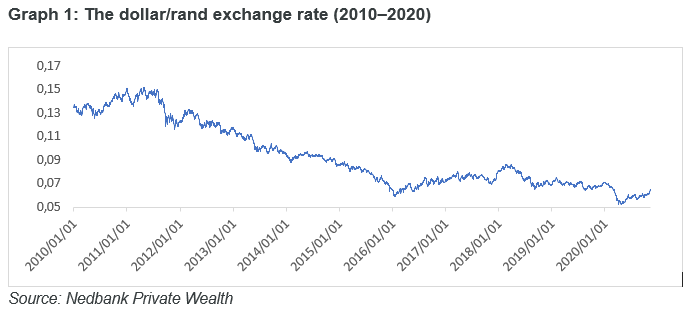

Fluctuations of the rand/dollar exchange rate over the past 20 years shows that timing is important.

At the end of 2010 the rand was strong, breaking the R7,00/$ mark and eventually reaching R6,66/$ (as shown in Graph 1). While the dollar regained some of its losses in 2011, the rand nevertheless remained strong, reaching $0,15/R towards the end of 2011.

From the beginning of 2012 to 2016 it became fairly expensive to buy US dollars, with R1 buying only $0,06 in January 2016. The previous period of weakening lasted for about four years. However, the following two years offered some relieve to investors and in February 2018 R1 bought you $0,09. This was followed by another weakening trend, with R1 buying $0,05 in April this year. In the second week of November, the rand strengthened aggressively on the back of the highly anticipated US election and an announcement of a Covid-19 vaccine, reaching $0,06/R.

So, what is the impact in practice? Let’s look at a South African tourist case study. As Table 1 highlights, a strong rand benefits South Africans touring abroad – you get more foreign currency for each rand, and consequently the cost of the trip in rand is lower. Let’s consider an example. Ben has saved up R50 000 for a trip to the US. In January 2010, R1 bought $0,15, which means Ben would have had $7 500 to spend. In January 2016 the rand weakened to $0,06/R, which means Ben would have had only $2 615 to spend. By April 2018, R1 bought $0,08, giving Ben $4 200. Clearly, 2010 was the year for South Africans to buy US dollars.

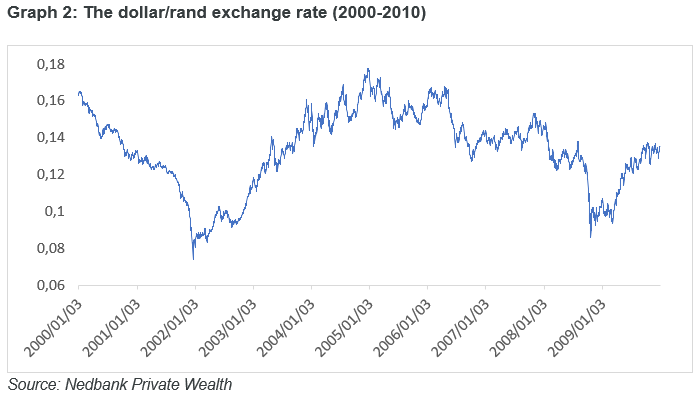

Choosing the right time to send money offshore can be tough.

When the rand is weak, many investors tend to take the stance of ‘waiting for a stronger rand’. They might say they will wait for periods similar to 2010 to 2012, or 2016 to 2018. Or they wait for a specific event, such as the US election, or a Covid-19 vaccine. However, the volatility in the exchange rate in the 10-year period leading up to 2010, shown in Graph 2, illustrates that this is not always that simple.

You can reduce the impact of movements in the rand through ‘dollar-cost averaging’.

Dollar-cost averaging (DCA) – also known as the constant-dollar plan – is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases to reduce the impact of volatility on the overall purchase. The purchases occur at regular intervals, regardless of the asset's price. The strategy therefore removes the time and effort of attempting to time the market in buying assets at the best prices.

When it comes to sending money abroad and dealing with exchange rates, DCA reduces the overall impact of volatility in rand trading levels. In practice this means that, instead of buying dollars (or whichever currency you want to buy) with your full R1 million or R10 million allowance, you will divide the amount into regular purchases at certain intervals, for example monthly or quarterly. As the value of the rand will likely vary each time one of the periodic investments is made, you neutralise any short-term volatility in the currency. Said differently, DCA helps you avoid making one big, poorly timed lump sum investment.

With our integrated international banking and investment platform, it’s easy to invest internationally and keep track of your money.

Sending money abroad can be daunting, but with our Focus platform you have convenient access, seamless control and expert support for your international investments:

- Benefit from a current account in US dollars, euros or pounds and choose additional currencies – up to 15 currencies in total.

- Invest in a wide range of markets and geographies using our managed solutions, global-trading functionality and related investment services.

- Experience seamless local as well as international client service support, and benefit from our expertise across jurisdictions.

- Enjoy convenience and control with 24/7 online account access.

Contact us to find out more about how we can connect you to international investment opportunities.

Speak to your wealth manager or private banker for expert advice. Or call us on 0860 111 263 if you are not a client yet and would like to get in touch with one of our advisors.

If you would like to find out more about the Focus platform specifically, send an email to FocusQueries@Nedbankprivatewealth.co.za.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.