Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

September 2021 market review: South Africa

While the better-than-expected GDP growth and move to lockdown level 1 is good for South Africa, local markets had a volatile quarter.

A vote for level 1

On the last day of the month, South Africa moved to adjusted alert level 1, further relaxing restrictions on movement and trade. After a ruling by the Constitutional Court, local elections will now go ahead, with the Independent Electoral Commission confirming the November date.

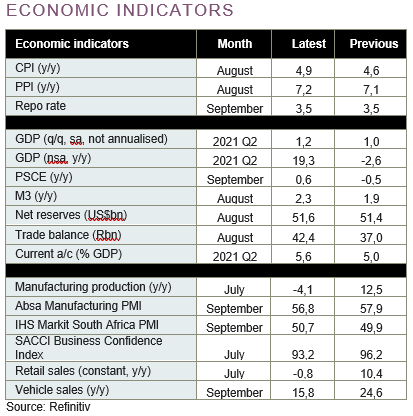

The economy recorded quarterly GDP growth of 1,2% (not annualised), exceeding market expectations yet again. With growth for the first half of the year ahead of expectations, market participants, including credit ratings agencies, upgraded their 2021 GDP forecasts, despite the damage from the civil unrest in July. Activity data released over the month confirmed the negative impact of the unrest in July on the economy and confidence, but forward-looking measures also suggest a recovery is underway as businesses get back to operation. The rand weakened by about 1,7% against the US dollar in September, while a rise on global bond yields weighed on the local bond market. The South African Reserve Bank kept interest rates unchanged but highlighted increased risks to near-term inflation.

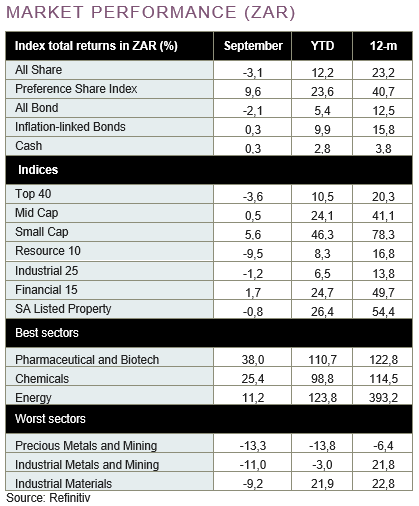

Governor Lesetja Kganyago again expressed a preference for a lower inflation target, a topic that will no doubt gain prominence. The All Bond Index declined by 2,1% in September, bringing the returns over the quarter to 0,4%.

Bank preference shares rallied over the month after Nedbank announced that it was considering making an offer to buy back all outstanding listed preference shares. This helped the asset class gain 9,6% over the month and 16,7% over the quarter, making it the best performing asset class over the period.

It was a volatile quarter for the local equity market, with regulatory changes in China and moderating global growth weighing on the market’s largest companies and the commodity complex. The resources sector lost 9,5% in September, driving the FTSE/JSE All Share Index down 3,1% over the month.

The big drivers of performance over the quarter were losses from index bellwethers Prosus (-14,5%) and Naspers (-16,9%) and a decline in the resources sector (-3,8%), particularly precious metals. With less exposure to global risk factors, domestically exposed small and mid-cap counters outperformed large cap counterparts over the quarter.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.