Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

April 2022 market review: South Africa

South Africa faces a national disaster due to the floods in KwaZulu-Natal, leading to declines in economic growth in Q2, while local bond and equity markets experience declines.

National disaster

Flooding in KwaZulu-Natal led to a devastating loss of lives, damage to property and infrastructure, and business disruption across the province. A national state of disaster was declared to allow mobilisation of resources. Continued load-shedding across the country added to the challenging backdrop and risk to the Q2 economic growth outlook, while ongoing strikes in the mining sector also cloud the outlook. On a positive note, Telkom withdrew its high court appeal against the Independent Communications Authority of South Africa (ICASA), validating the recent spectrum auction results.

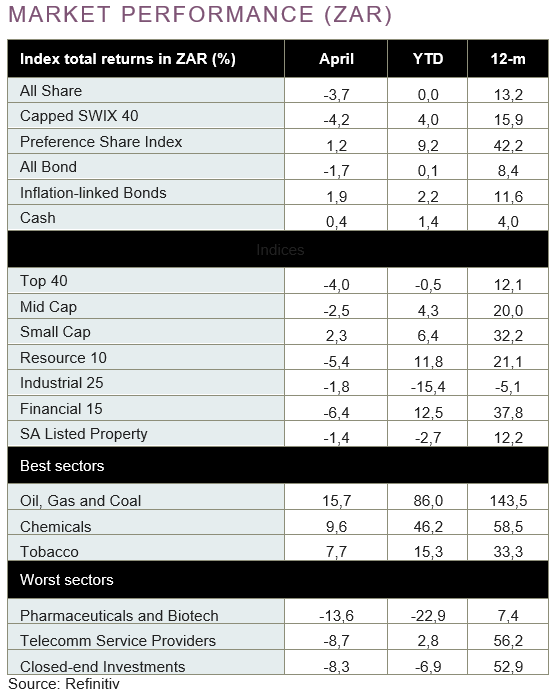

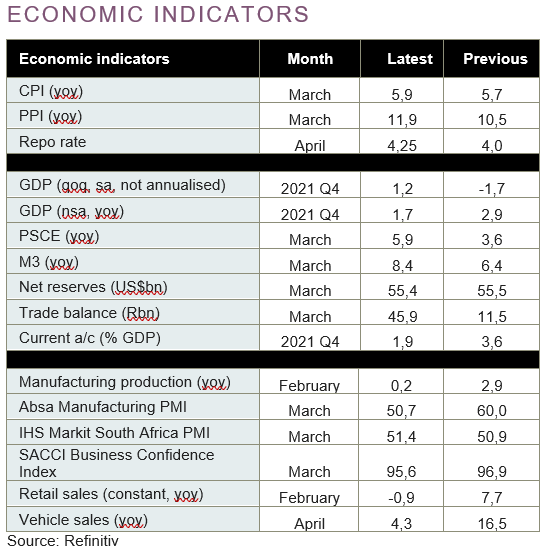

Credit ratings agency Moody’s upgraded the outlook for South Africa’s credit rating to stable from negative, reflecting an improved fiscal outlook. Preliminary tax and monthly budget data suggest the revenue trends remain constructive, although investors and rating agencies alike acknowledge that external factors such as high commodity prices remain a big driver. Having demonstrated resilience in the face of global volatility, the local bond market and currency gave way to weakness mid-month. Headline inflation increased to 5,9% yoy in March, reflecting higher fuel and food prices, despite a temporary reduction in the fuel levy. Against this backdrop, inflation-linked bonds delivered 1,9%. The All Bond Index declined by 1,7% in April and the rand weakened by about 8,3% against the US dollar.

Local equity markets lost ground, with the FTSE/JSE All Share Index declining by 3,7%. Technology counters Naspers and Prosus continued to slide over the month, with the index dragged down further by losses in the financials (-6,4%) and resources sector (-5,4%).

Domestically exposed small-cap counters ended in the green, outperforming their mid- and large-cap peers. With many holding companies attracting relatively large discounts in the South African market, corporate actions have increased as companies look to unlock value for shareholders and reconsider a future-fit strategy. PSG Group reaffirmed a proposed restructuring that will see the business unbundle its stakes in listed entities such as Curro and PSG Konsult and thereafter repurchase outstanding shares with the intention to delist from the JSE. Pending shareholder approvals, the corporate action is proposed for August. RMI Holdings Limited also unbundled its stake in Discovery and Momentum Metropolitan Holdings in April. The end of an era in some cases, but for others the start of a more focused path.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.

| Legal disclaimer |

| Nedgroup Private Wealth Proprietary Limited and its subsidiaries (we, us, our) have issued this communication for information purposes only, so you must not rely on it as though it is advice, without getting financial, tax or other professional advice. We collected the information in this communication from various sources and have included facts and events or market conditions that were current at the time of going to print. We do not warrant that this information is complete or accurate, or that it is appropriate for investors in all jurisdictions to use this information. The opinions and recommendations given may change without notice. We and our employees may hold securities or financial instruments mentioned in this information. This information is not an offer or solicitation of financial services or products, and we do not accept liability for any loss or damage, including, but not limited to, loss of profits or any financial or other monetary or direct or special indirect or consequential loss, however arising, whether from negligence or breach of contract or other duty as a result of this information being used or relied on. |