Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

January 2022 market review: International

Find out how rising growth and inflation rates, and signals for earlier-than-expected rate hikes, affected markets in January.

New highs

Global activity data suggests that manufacturing held up towards the end of the year, despite renewed lockdown measures in many countries. Services, as expected, were impacted to a greater extent as travel bans and limitation on movement dampened some festive cheer. The US economy grew by an annualised 6,9% in the fourth quarter, supported by consumer spending ahead of the typical festive season. The US recorded GDP growth for 2021 at 5,7%, the highest annual rate in decades. The IMF released its World Economic Outlook for 2022, forecasting global growth of 4,4% for the year, a downgrade from the previous forecast of 4,9%.

Although energy costs and food inflation remain active drivers of global inflation, inflation outcomes continue to exceed expectations, suggesting broadening pricing pressures. In December, US inflation (7,0% yoy) reached the highest level since 1982. Eurozone inflation also recorded a new historic high, reaching 5,0% year on year in December. At 5,4%, the UK recorded its highest inflation reading in 30 years.

China recorded economic growth of 4,0% yoy in the fourth quarter, bringing full-year growth for 2021 to a credible 8,1%. Growth momentum has however been slowing in the latter half of the year, as a weaker property sector and the country’s strict Covid-19 policy and restrictions weighed on the economy. In contrast to the rest of the world, inflation in China has shown early signs of moderation. With the emergence of Omicron and moderating inflation prints, Chinese policymakers have started easing policy, including cuts to several benchmark lending rates.

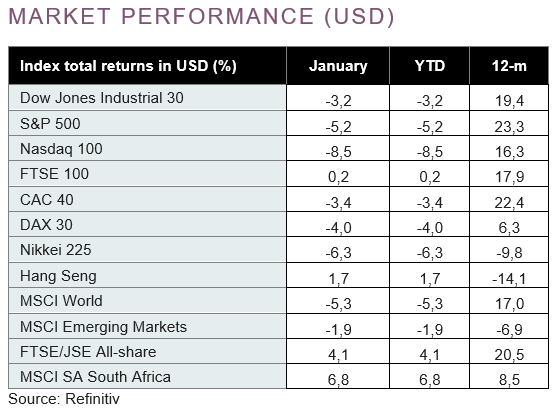

Global equity markets had a tough start to the year with several developed markets experiencing drawdowns. The S&P 500 lost 5,2% in January, while the technology-heavy Nasdaq 100, which largely comprise growth stocks sensitive to interest rates, declined by 8,5%. Many European indices also lost ground, while the UK’s FTSE 100 managed a mere 0,2%. Emerging markets also lost ground, with the MSCI Emerging Markets Index declining by 1,9%. This, despite a recovery in the Hang Seng, which gained 1,7%. The MSCI World Index declined by 5,3% in the first month of 2022, bringing returns over the last twelve months to 17,0%.

Opec+ confirmed another gradual increase to production from February but given that these targets have not been met of late, this did little to appease medium-term supply or price concerns. The upward march in oil prices accelerated as geopolitical tensions between Russia and the Ukraine remain high, and with it the potential for supply disruption. The price of Brent crude oil ended the month above $90, a roughly 17% increase from the start of the year.

Global bond markets traded under pressure, as bond yields rose to reflect more hawkish sentiment. The US 10-year bond yield jumped in the first few weeks, ending the month at 1,78%, the highest level since April 2020. In US dollar terms, the Barclays Global Aggregate Index declined by 2,0% in January.

The main game in town

In December, the US Federal Reserve (Fed) communicated an accelerated pace of tapering of bond purchases to end in March 2022, and signalled earlier interest rate hikes. But it was the hawkish minutes from this meeting, released in January, and several eye-watering high-inflation prints that sent the markets climbing the wall of worry. Commentary from Fed governors later in the month brought into focus the possibility of a hike as early as March, and consideration for increments of 50 bps. Fed chair Jerome Powell’s comments at the January meeting confirmed plans to decrease the Fed’s balance sheet and convinced some economists that seven hikes over 2022 were possible. With US unemployment down to 3,9%, within distance of prepandemic levels, markets now consider many suggestions not only possible but also probable. If the market’s response in the first month of this year is anything to go by, 2022 is going to be a volatile year, with policymakers setting the tone.

Want to know more? Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0860 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth Pty Limited and its subsidiaries (we, us, our) have issued this communication for information purposes only, so you must not rely on it as though it is advice, without getting financial, tax or other professional advice. We collected the information in this communication from various sources, and have included facts and events or market conditions that were current at the time of going to print. We do not warrant that this information is complete or accurate, or have anything to say about whether it is appropriate for investors in all jurisdictions to use this information. The opinions and recommendations given may change without notice. We and our employees may hold securities or financial instruments mentioned in this information. This information is not an offer or solicitation of financial services or products, and we do not accept liability for any loss or damage, including, but not limited to, loss of profits or any financial or other monetary or direct or special indirect or consequential loss, however arising, whether arising from negligence or breach of contract or other duty as a result of this information being used or relied on. Nedbank Private Wealth, an authorised financial services provider through Nedgroup Private Wealth Pty Ltd Reg No 1997/009637/07 (FSP828), a registered credit provider through Nedbank Ltd Reg No 1951/000009/06 (NCRCP16), a member of JSE Ltd through Nedgroup Private Wealth Stockbrokers Pty Ltd Reg No 1996/015589/07, an authorised financial services provider (FSP50399) and a registered credit provider (NCRCP59). |